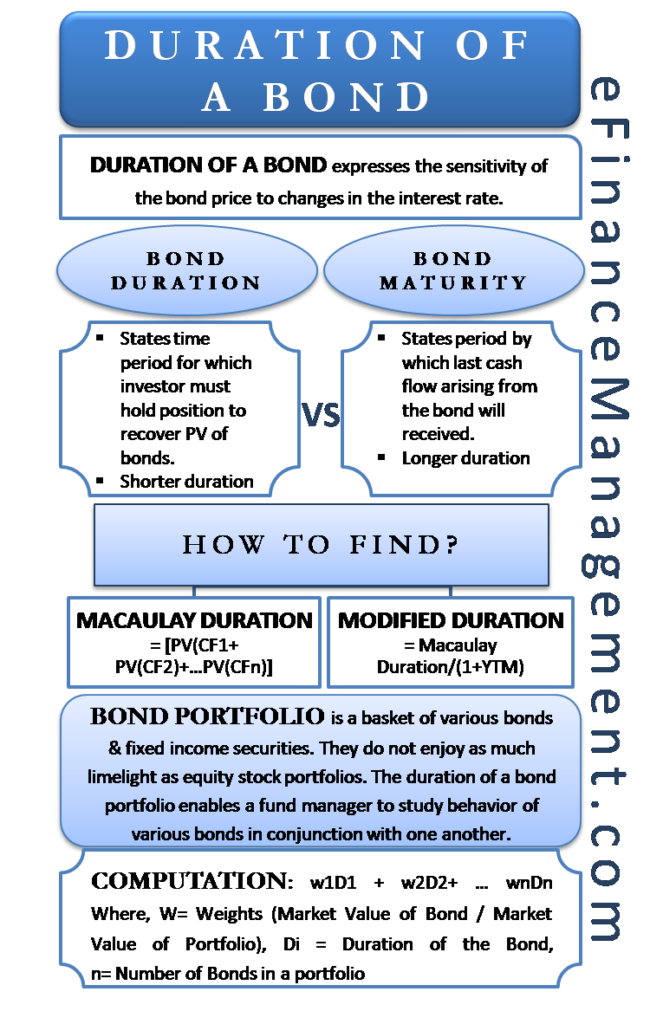

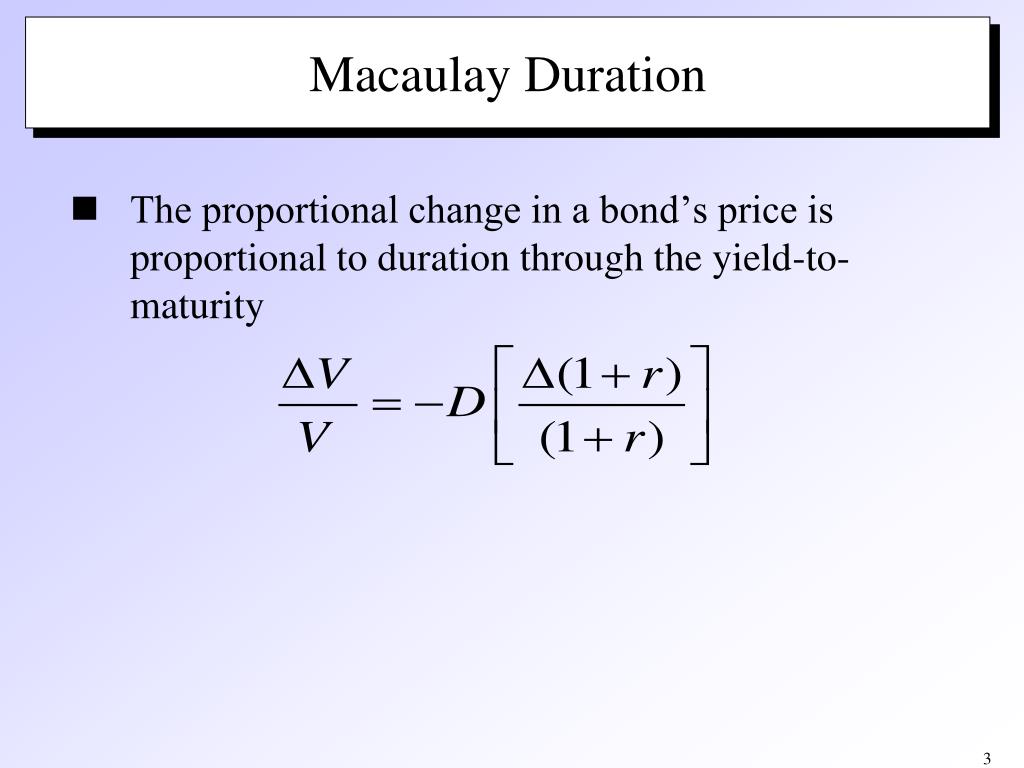

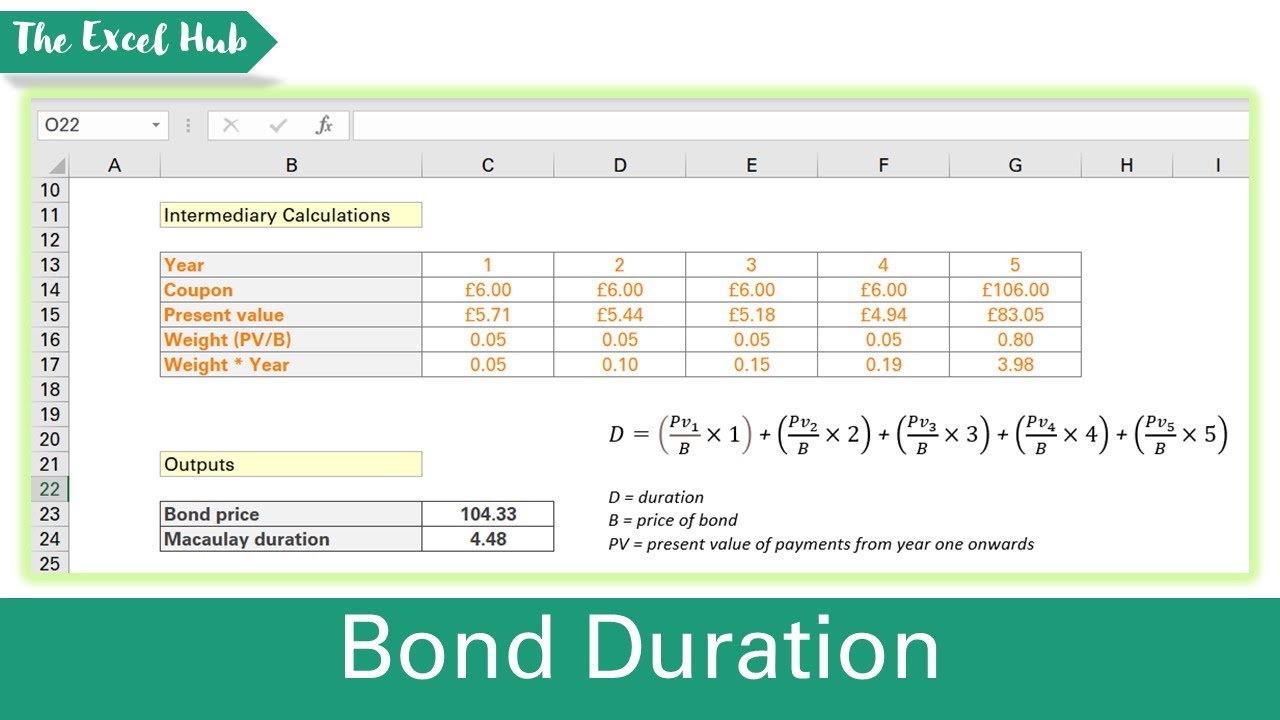

Calculate the Macaulay duration of a 5-year bond with a 12% annual coupon rate and a $1,000 face value. Assume the current market price is also $1,000 – what is the modified duration? Use this to estimate the change in value if rates increase by 50bp.. Macaulay Duration: The Macaulay duration is the weighted average term to maturity of the cash flows from a bond. The weight of each cash flow is determined by dividing the present value of the.

Modified Vs Macaulay Duration PDF Bond Duration Bond Market

Macaulay Duration Bond Duration Explained Interest rate risk FINEd YouTube

What Is Duration? Macaulay Duration, Modified Duration and Convexity Financial Pipeline

Macaulay Bond Duration Excel Template Ryan O’Connell, CFA

PPT Chapter 10 PowerPoint Presentation, free download ID1138614

Macaulay Duration YouTube

Macaulay Duration of an Annual Coupon Bond YouTube

Macaulay Duration of a Semi annual coupon bond YouTube

Modified Duration Formula Calculator (Example with Excel Template)

Managing Bond Portfolios Bond Strategies, Duration, Modified Duration, Convexity, etc

Duration and convexity are important bond concepts Financial Pipeline

Macaulay Duration Formula Example with Excel Template

PPT Bond Duration PowerPoint Presentation, free download ID5585530

Macaulay and Modified duration YouTube

Macaulay Duration Bond

Duration of a Bond Portfolio Duration Macaulay & Modified Duration

PPT Bond Duration PowerPoint Presentation, free download ID5585530

PPT Duration and Convexity PowerPoint Presentation ID280626

Calculate The Macaulay Duration Of A Bond In Excel YouTube

ACCA AFM Macaulay Duration Bond Duration YouTube

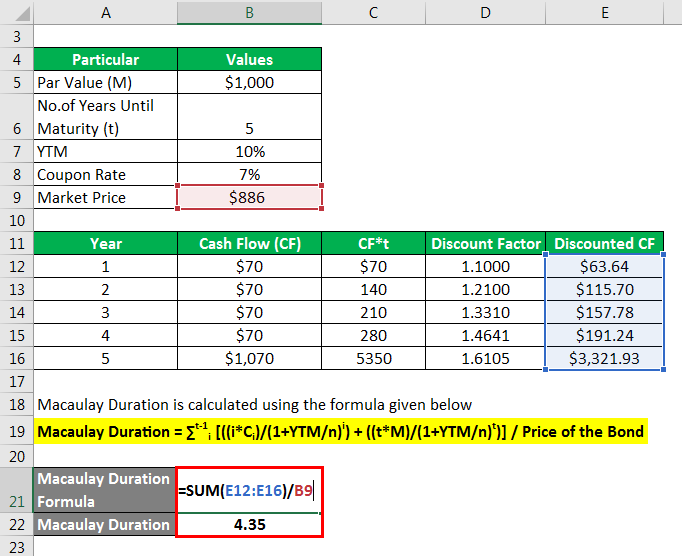

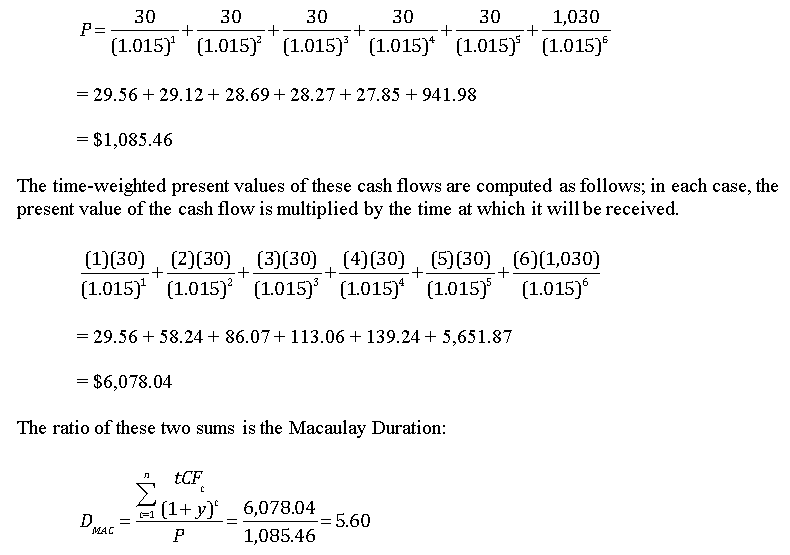

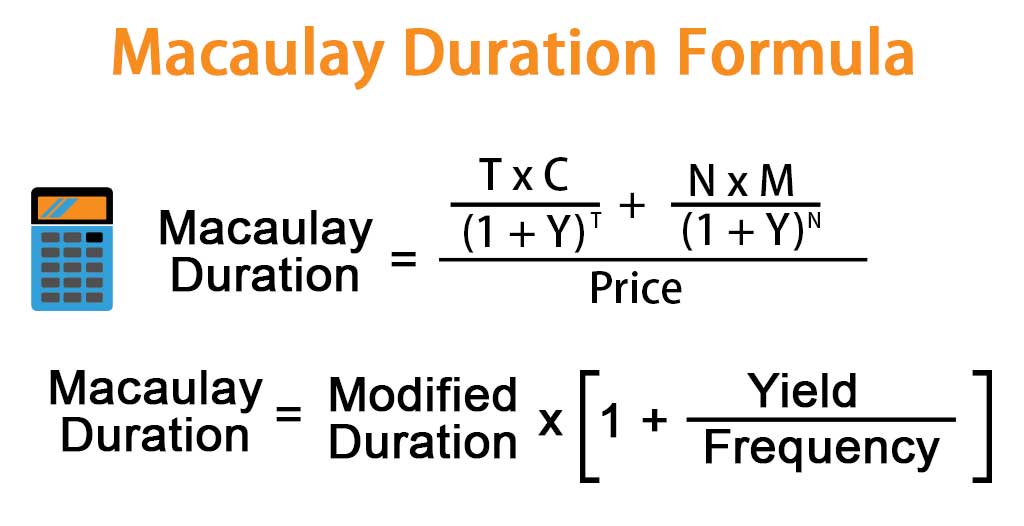

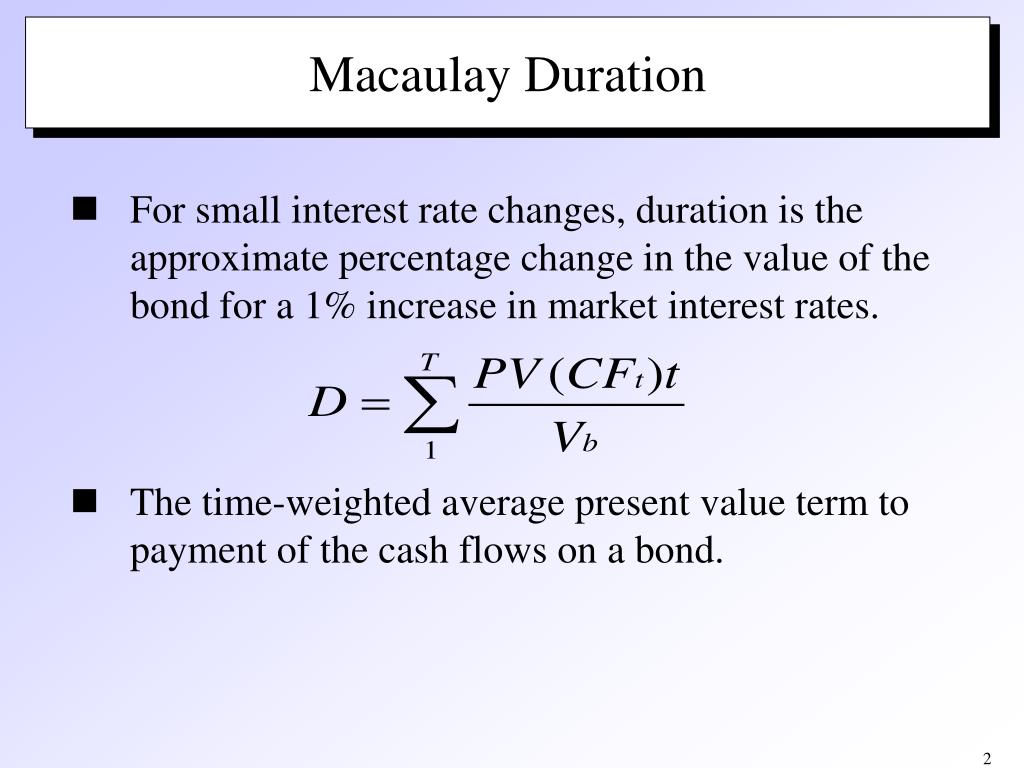

To calculate Macaulay duration: Identify all the cash flows. Discount each cash flow to its present value using the bond’s yield. Divide each present value by the bond’s full value to get the weights for each year. Calculate the Macaulay duration by summing the product of each weight and the number of years to the payment of the cash flow.. Macaulay Duration. Calculation of Macaulay Duration will be -. Current Bond Price = PV of all the cash flows 6,079.34. Macaulay Duration = $ 6,079.34/ $1,000 = 6.07934. You can refer to the given excel template above for the detailed calculation of Macaulay duration.